Management consultants iowell provide a routine for validating VAT ID numbers with SAP® systems. The tool offers an integrated validation solution for master data and for document data relating to accounts payable and receivables.

Key features

- Automatic and manual online validation of VAT ID numbers, along with the company name (including the legal form according to the commercial register), city, street and zip code

- Verification by the Federal Central Tax Office (Bundeszentralamt für Steuern) in accordance with German VAT legislation

- Integration of online validation as a background process during order processing and the creation of delivery notes and invoices

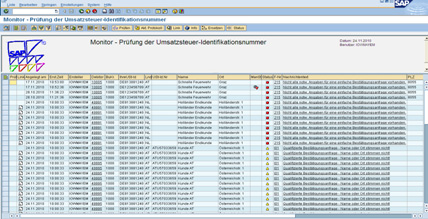

- Recording of validation results in a dedicated audit log table in the SAP® system for audit purposes

- MLog-table monitor and functionality for analyzing and editing log entries. Where required, a log entry can be manually linked to a document (order, delivery note or invoice). The monitor enables users to correct master data and resubmit a query.

- Option of selecting only those receivables for which there are active documents. This prevents the routine from checking all master data every time a validation is performed.

- Functionality for customizing the SAP add-on